Corsec RATU - 30/04/2025

RATU Holds Inaugural AGMS and Distributes IDR 108 Billion in Cash Dividends

Jakarta, April 30, 2025 – PT Raharja Energi Cepu Tbk (IDX: RATU) has held its Annual General Meeting of Shareholders (AGMS) for the 2024 Fiscal Year today, Wednesday (30/04), at the Thamrin Nine Ballroom, Chubb Square, Central Jakarta. The meeting was conducted in a hybrid format, combining physical attendance and online participation, allowing shareholders who were unable to attend in person to join the AGMS virtually via the electronic system provided by KSEI. This AGMS also marks RATU’s first shareholders’ meeting as a publicly listed company, following its official listing on the Indonesia Stock Exchange on January 8, 2025.

The 2024 AGMS met the quorum requirements in accordance with applicable laws and regulations. The meeting discussed six (6) agenda items:

1. On the first agenda, shareholders approved the Company’s Annual Report and ratified the Consolidated Financial Statements, along with the Supervisory Report of the Board of Commissioners for the 2024 fiscal year. A key highlight of this agenda was the Company’s full-year revenue recognition for the first time, as opposed to only 10 months in 2023. However, net profit experienced an adjustment due to an increase in the Cost of Goods Sold (COGS), particularly related to oil and gas production costs in the Jabung Block. The year 2023 was a transition period for the Jabung PSC extension, which led to suboptimal spending in the block, requiring certain costs to be carried over into 2024.

2. On the second agenda, shareholders approved the distribution of cash dividends amounting to IDR 108 billion, equivalent to IDR 40 per share. This decision reflects the Company’s commitment to delivering shareholder value and aligns with its pledge made in the prospectus during the initial public offering (IPO). The dividend represents 46% of the Company’s 2024 net profit, demonstrating a balanced approach between shareholder returns and optimal fund allocation to support sustainable expansion and investment. This also reaffirms the Company’s consistency in generating value amid evolving industry dynamics.

Dividend Distribution Schedule:

- Recording Date: May 15, 2025

- Cum Dividend in Regular and Negotiated Market: May 9, 2025

- Ex Dividend in Regular and Negotiated Market: May 14, 2025

- Cum Dividend in Cash Market: May 15, 2025

- Ex Dividend in Cash Market: May 16, 2025

- Dividend Payment Date: June 4, 2025

3. On the third agenda, shareholders granted authority to the Board of Commissioners to determine the remuneration and other benefits for the Board of Directors. Additionally, the honorarium and allowances for the Board of Commissioners were also approved, taking into account industry competitiveness and the Company’s current financial condition.

4. On the fourth agenda, shareholders authorized the Board of Commissioners to appoint a Public Accounting Firm (PAF) to audit the Company’s Consolidated Financial Statements for the 2025 Fiscal Year. The appointment will consider professionalism, independence, and the PAF’s track record to ensure quality and accurate auditing, supporting transparency and sound corporate governance.

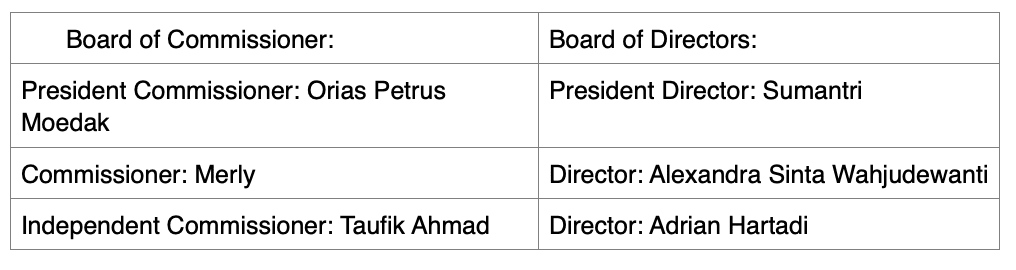

5. On the fifth agenda, the Meeting discussed changes in the composition of the Company’s Board of Commissioners and/or Board of Directors. In this meeting, the shareholders approved the honorable discharge of Ms. Alexandra Sinta Wahjudewanti as President Director, Mr. Bagus Pinandityo as Director of the Company, and Mr. Sumantri as President Commissioner of the Company. Subsequently, the shareholders approved the appointment of:

- Mr. Sumantri, who previously served as President Commissioner of the Company, was appointed as President Director of the Company.

- Ms. Alexandra Sinta Wahjudewanti, who previously served as President Director of the Company, now serves as Director of the Company.

- Mr. Adrian Hartadi was appointed as Director of the Company. Mr. Adrian has a strong background in the financial and investment sector, with extensive experience in financial institutions and investment companies, particularly in the energy sector, such as Chandra Daya Investasi.

- Mr. Orias Petrus Moedak was appointed as President Commissioner of the Company. Mr. Orias brings extensive experience from various state-owned enterprises (SOEs), and previously served as an Independent Commissioner at RATU’s parent company, PT Rukun Raharja Tbk.

- Ms. Merly was appointed as Commissioner of the Company. Ms. Merly has more than 15 years of experience in the energy industry, and currently serves as a Director at Star Energy Geothermal Group, PT Barito Renewables Energy Tbk, as well as PT Chandra Daya Investasi.

With these changes, the composition of the Company’s Board of Directors and Board of Commissioners for the term until the close of the Annual General Meeting of Shareholders for the 2027 Fiscal Year is as follows:

6. On the sixth agenda, the Company presented a detailed report on the use of proceeds from its IPO, which, in line with the prospectus, were primarily allocated for loans to subsidiaries and associated entities. These loans support capital calls and business development, including working capital. Of the total IPO proceeds received by the Company amounting to IDR 218,561,870,000, the remaining available funds as of April 2025 stood at IDR 118,487,826,018. This report reflects the Company’s transparency and commitment to using its financial resources effectively to accelerate growth and business development.